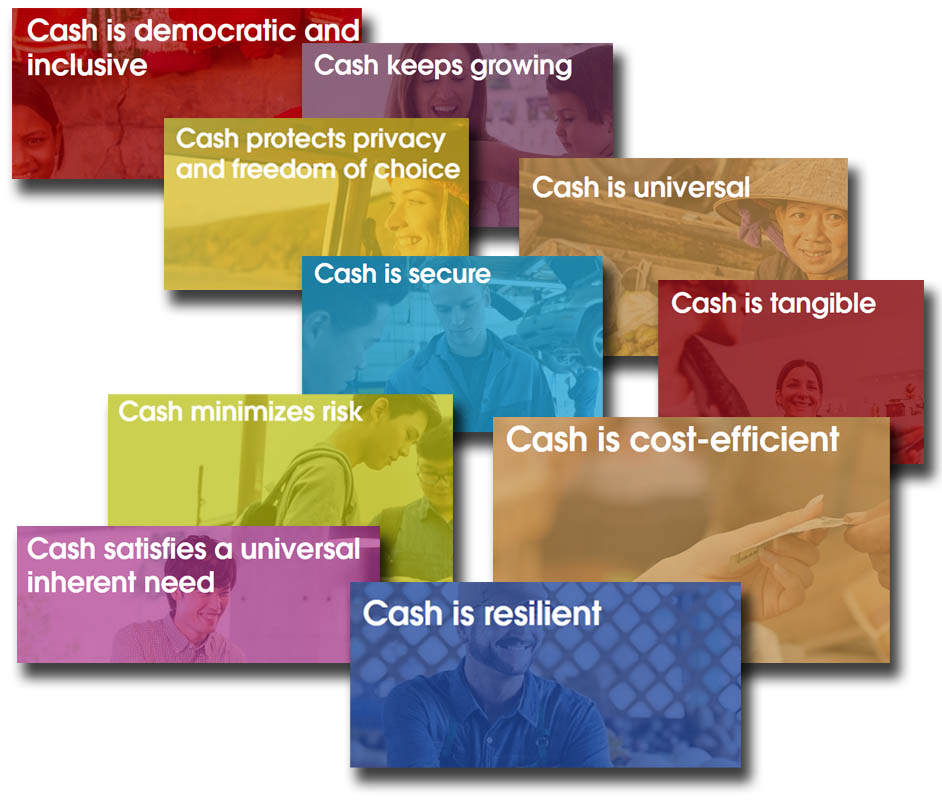

Access to cash is a constitutionally guaranteed right. Cash is available to anyone and everyone, regardless of their social status, financial standing or creditworthiness. Cash does not involve fees and no registration is needed to obtain, spend or accept it. Cash is the only truly democratic form of payment and a significant societal equaliser. Cash is also the payment means of choice for the visually impaired. Many countries issue banknotes with features specifically tailored to this group.

Cash protects privacy and freedom of choiceCitizens are entitled to privacy and the protection of their data. In an era where every digital and mobile transaction leaves a data trail, paying cash is the only way to protect this right to privacy. When it comes to purchases, personal preferences should remain exactly that – personal. Abolishing cash would infringe both on citizens’ rights to informational self-determination and on freedom of choice. In addition, tracking purchase histories leads to people becoming the target of selective advertising, all the time and everywhere, online and offline.

Cash keeps growingCash is a growth market, with regard to both the product itself and to the infrastructure that surrounds it. The Federal Reserve note print order for 2017, for example, amounts to approximately 7.1 billion Federal Reserve notes, valued at $209.0 billion. The global ATM (Automatic Teller Machine) will register compound annual growth of 9.85% over the next half-dozen years. Finally, the amount of currency in circulation has been growing at an average annual rate of approximately 5%.

Cash is secureThere is no form of payment as secure as cash. With sophisticated security architecture and continuous innovation in security eatures, cash is almost impossible to counterfeit. While statistics show, year on year, an exponential rise in card fraud, cybercrime and online fraud, the number of counterfeit banknotes e.g. in the EU remains at the almost inconceivable low of ~0.0017x%. In the UK, for instance, the face value of counterfeit banknotes amounted to 7.5. million pounds sterling in 2016 compared to an annual 'financial fraud [loss] across payment cards, remote banking and cheques' that amounted to £755 million in 2015, [which shows] an increase of 26 percent compared [with] 2014. The latest counterfeit statistics from the European Central Bank show cash to be 99.9983% secure.

Cash is universalCash is still the payment method of choice for daily transactions for a large number of people, both in developing and in industrialised countries. In many developing countries with a large number of unbanked or underbanked people, cash is often the only payment method available. Even in the US, according to Forbes, roughly 28% of US households conduct some or all of their financial transactions outside the mainstream banking system. Although there are significant geographic variations, an estimated 80% of all payments worldwide are still made using cash. M-Pesa in Kenya may have had half a trillion transactions in 2012, but 99% of all retail transactions following the transfer of money via M-Pesa were still conducted in cash. Even in the US, at 32%, cash makes up the single largest share of consumer transaction activity and is the dominant instrument for low-value payments.

Cash minimizes riskWith cash, there is no need to put all your eggs in one basket. Countless scenarios consider the risk of a terrorist attack on a country’s financial infrastructure. If that were to happen, it would lead to a complete breakdown of all financial services. Without cash, the country in question would no longer be able to function; with cash, the economy can be kept going. Myanmar, for example, has been functioning on cash alone ever since its financial infrastructure collapsed in 2003. In the private domain, the same principle applies: even in the very unlikely event of encountering a counterfeit banknote, it would be an exception. When someone hacks a system to obtain a user’s password, thereby circumventing their online security, a victim’s account may be emptied completely and all financial reserves wiped out.

Cash is tangibleCash helps cost control! Control of spending and household expenses – may be vital for a large number of people, but it is also hard. Digital and virtual forms of payment make this even harder, as paying by smartphone or credit card render expenses invisible and abstract. Money spent is no longer money out of pocket and is therefore difficult to monitor. People spend more money, and often more than they can afford when they don’t pay cash.

Cash satisfies a universal inherent needHistory has shown that the concept of monetary systems involving tangible values – from cowrie shells and beads to sacks of grain and cigarettes (as illustrated in the famous Radford study, “The Economic Organization of a POW Camp”) – constitutes archetypical behavior and is deeply entrenched in the collective consciousness of all peoples. If cash is taken away from people, they will, invariably, find other ways of exchanging tangible values, most likely neither as safe nor as controlled. Cash also reflects a nation’s identity. Banknotes and coins are often a nation’s calling card, valued by people beyond their monetary worth. Their motifs depict a people’s defining moments and historic landmarks.

Cash is resilientIn a crisis, a solid financial system has to prove how robust it is. Empirical data shows that in a crisis situation, the demand for cash typically rises sharply. The reason for this phenomenon is: trust in real currency. Cash is item number five on the US Homeland Security emergency supply list, right after medication, infant formula, pet food, and family documents. There have been many natural disasters as well as political and economic crises in recent years. During major floods, earthquakes or tornados, almost inevitably more money is printed to meet the rising demand for cash. Banknote circulation usually remains uninterrupted because cash is kept at central banks’ offices outside the natural disaster areas. How do you pay via card or smart device when the electronic infrastructure has crashed? Cash does not crash.

Cash is cost-efficientEven though the methods of valuation may vary – because the provision of cash is a national responsibility – it is possible to establish the cost of cash for every nation, and figures are available and transparent. Cash payments have the lowest social costs. Due to a lack of reliable data, meaning a lack of transparency, so far nobody has been able to estimate the cost incurred in developing and setting up countless technologies and systems that guarantee security for virtual payments. They do not show up in any statistics. These costs are privatized, that is to say paid for by the retailer and the customer. At the same time, the cost of cybercrime is high. In 2015, in its Special Eurobarometer on cybersecurity, the EU noted: “Whilst the value of the cybercriminal economy as a whole is not precisely known, the losses are thought to represent billions of Euros per year.”